On this Monday morning, the world of stock market news was full of one headline:

AMD stock increased after an unexpected collab with OpenAI.

AMD has signed an agreement with OpenAI to supply them the cutting edge GPU chips to grow AI infrastructure. This is not just a small product order – it’s a big deal. As AMD will deliver GPU power up to 6 gigawatts over the next several years. The first batch is arriving in the second half of 2026.

This deal has given advantage to OpenAI to acquire up to 10% ownership of AMD. This could be meant to buy 160 million AMD shares.

This can be a game-changing movement for analysts and tech investors. This AMD OpenAI deal could be the opening of a new phase in the AI chip market. As AMD is coming up as an Nvidia competitor.

Why This Partnership Matters

We all have witnessed the dominance of Nvidia in the AI Chip market for years. Nvidia has always been the first choice for AI developers when they need any powerful GPUs.

But now AMD Stock is stepping into this zone as an Nvidia competitor with strategy.

A comment passed by co-founder of Comet.ai, Joshua Patterson, as “a step toward shaping the future of AI computing.” For AMD, it’s not just a contract. But a strategic move to play in the market of AI hardware.

AMD is providing AI infrastructure to OpenAI, not just for increasing its business of GPU Supply. But also to maximize its credibility among the investors.

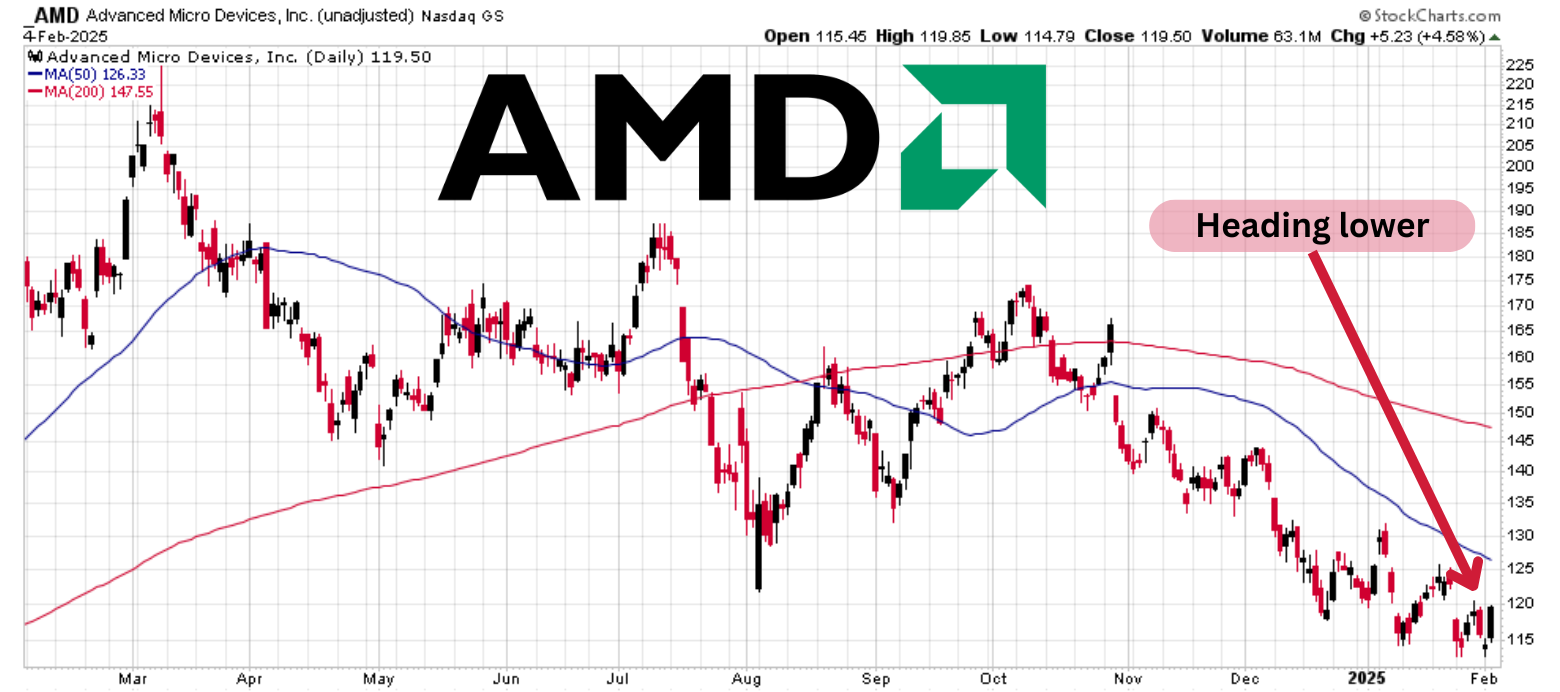

AMD Stock Today: Numbers That Matter

AMD Stock already had strong momentum even before the announcement of the OpenAI deal.

In Q2 2025, AMD reported:

- Revenue: $7.685 billion (up 32% year‑on‑year)

- Net income: $872 million

- Earnings per share (EPS): $0.54 (GAAP), $0.48 (non‑GAAP)

This data is showing that the company will maintain growth and profitability. Even after having problems like U.S. export restrictions on certain GPUs – which can provide revenue of $800 million to AMD.

With this partnership of OpenAI, analysts are predicting the potential growth in AMD’s revenue.

With the OpenAI partnership, analysts believe AMD’s revenue potential will grow tens of billions of dollars.

Challenges AMD Faces

While the AMD OpenAI deal is on a boom, still AMD must go through some risks.

- Supply chain issues: This could be a challenge for AMD to build these high-performance GPUs in bulk, and global shortages could slow delivery.

- Export restrictions: Trade limit to some advanced chips is also a threat to AMD as that could affect AMD’s global reach.

- Intense competition: Nvidia would not keep silent- it can bring more powerful GPU innovations that can pressure AMD.

For investors, these risks mean AMD stock could remain changeable in the short term, even if the long‑term scenario is strong.

What This Means for AMD’s Future

This partnership has positioned AMD for a big role in AI growth. With this OpenAI deal of supplying GPUs for OpenAI’s projects, AMD not only gained revenue but the reputation and industry influence too.

This is beneficial to AMD as it can help AMD to provide more AI partnerships in the future. It can include other AI companies and research institutions too. It could give vision to AMD to fund more in R&D. As it can do more research on innovations in AI chips and GPU supply.

For tech investors, the question is: Will AMD Stock maintain its flow in the long run? Can it deliver better results in this partnership?

If AMD succeeds, it could become a big win in the AI revolution — becoming an Nvidia competitor head-to-head and shaping the future of AI infrastructure.

Analyst Takeaways

From the expert point of view, AMD’s move is a strategic plan. But it comes with the risk of execution:

“AMD has positioned itself in one of the most promising parts of tech today,” commented by a senior market analyst.

This OpenAI deal could result in redefining its role in the semiconductor industry. But its success would totally depend on how its executed and supply chain management.

Analysts are also noticing that AMD Stock is still under closer review.

This partnership is giving AMD strong growth potential. But still the market is curious to know whether AMD can deliver without delays.

The Bigger Picture

This is a large trend in the tech world and for tech investors. As AI is not just a software- but hardware too. The demand for AI-specific chips and GPUs is increasing.

This moment is part of a larger trend: AI is not just software — it’s hardware too.

The demand for GPUs and AI‑specific chips is exploding. That means tech companies like AMD are moving into one of the fastest‑growing sectors of the tech world.

For AMD, the question isn’t just about this year or next — it’s about positioning itself for a decade of AI growth.

Conclusion

The recent high increase in AMD stock is not just a short‑term market reaction. It is showing a big shift in the AI chip market, where AMD is now emerging a challenger as Nvidia’s competitor.

For tech investors, AMD stocks are signalling opportunity and challenge, both — a high‑growth play tied to one of the most changing industries of our time.

If AMD delivers on its promise, the company could become a known industry in AI infrastructure for years to come.

Word up, peeps! Downloaded the uujlapp. It’s smooth and easy to use on my phone! Definitely recommend if you’re on the go a lot.

Logging into hoki108login was a breeze. Quick and easy, no issues. That’s how it should be! Worth checking: hoki108login